Made 47k last year (realized gains) doing short term trades

Currently down about 20k (unrealized) this year, and with stuff opening back up I don't wanna spend as much time paying attention to my portfolio and stressing over it

Will have roughly 100k I want to start DCAing into the market over the coming year

with that amount of money, how would you divide it up in terms of how much to put in, and at what intervals?

I want a portfolio that's pretty simple. I'm aware of the 3 fund portfolio, but at my age (early 30's) and with bond rates at where they are, is there any reason for me to have money in a bond fund? seems silly considering how low they are.

Was considering VOO, QQQ, and something for international total market index. What's the etf equivalent of VTIAX?

|

|

-

05-23-2021, 02:45 PM #1Spoon Pic Connoisseur

- Join Date: Jul 2010

- Location: Portland, Oregon, United States

- Posts: 21,028

- Rep Power: 207614

Tired of day trading - help with DCA strategy and fund selection

Awesome pics. Great size. Look thick. Solid. Tight. Keep us all posted on your continued progress with any new progress pics or vid clips. Show us what you got man. Wanna see how freakin' huge, solid, thick and tight you can get. Thanks for the motivation.

-

05-23-2021, 03:15 PM #2

DCA is largely psychological in nature and will underperform lump sum the vast majority of the time (with the exception being severe market downturns). This isn't to say another crash couldn't happen next week or it may not happen for 10 years, nobody knows. So, if you want to be logical and statistics based then lump sum - if you feel that you need to DCA for your own psychology then there is really no wrong way assuming you commit to it and are hands off from that point forward. Otherwise you will find yourself back into the timing game.

As an example, I deposit the same amount to my taxable each and every month on the same day on market open independent of what the price is at that point.

I think the first thing you'll want to do is ensure that you have all of your available Roth IRA contributions maxed out. As far as bonds go, this is again going to be psychological. You know yourself best, however if you've been day trading then it sounds as if you have some risk tolerance and have many good earning years ahead of you.

This topic is debated a lot, and there are not going to be any singular right answer but I personally don't see any issue with a 100% stock allocation at your age. I currently do the same with all my accounts and will start allocating more to bonds as I get closer to my target net worth goals (rule of 25 is what I'm subscribing to now).

For the least amount of stress, just use VTI which is the total US stock market fund. That way you don't have to stress about which sector is hot at any given moment. If you were to do VOO or QQQ then you will miss out on small and lots of mid size market caps. Nobody knows nothin' but there are a lot who suspect that value and smaller market caps could outperform and with VTI you own them all. The only negative to this is that you don't have any international exposure so a combination of VTI and VXUS (VTIAX equivalent) covers absolutely everything. You can balance them dependent upon how much you think the US will continue to outperform. These things are cyclical so it stands to reason that VXUS may have its day in the sun at some point before you retire.

Generally speaking, always seek to maximize your pre-tax allocation if you have access. Currently you can personally contribute $19500 per year in retirement accounts and then move onto Roths (or tax advantaged) before messing with taxable accounts.http://stackingplates.com

http://instagram.com/mrstackingplates

-

05-25-2021, 07:30 AM #3Spoon Pic Connoisseur

- Join Date: Jul 2010

- Location: Portland, Oregon, United States

- Posts: 21,028

- Rep Power: 207614

Great fukin post. Thank you so much for taking the time to type all this out, I really appreciate it.

One reason I wanted to DCA is because so far the rebound from last March's crash has mapped almost perfectly onto what the market back in 2009 after the crash

https://twitter.com/RyanDetrick/stat...927624/photo/1

if it continues it looks like the markets in for more dips/sideways trading the next few months so I figured DCAing would be the best strategy.Awesome pics. Great size. Look thick. Solid. Tight. Keep us all posted on your continued progress with any new progress pics or vid clips. Show us what you got man. Wanna see how freakin' huge, solid, thick and tight you can get. Thanks for the motivation.

-

05-25-2021, 07:53 AM #4Go fuсk yourself.

- Join Date: Jan 2011

- Location: Colorado, United States

- Posts: 22,071

- Rep Power: 539980

Here's what I would do:

1) Put the $100k lump sum into tech stocks or tech-heavy ETF's immediately. Don't DCA that. Tech is on it's way up, but still relatively low from the drop.

2) Max out retirement as fast as you can at the beginning of the year into tech-heavy ETF's. I contribute 20% of each paycheck/commission check and max it out as early as possible in the year. (Roth first, unless you're in a higher tax bracket, then do all traditional first as this immediately saves you 30% in taxes on that income). Depending on your income level, traditional contributions will help keep your AGI down on your taxes. These savings will massively add up over time. Then max out Roth at the end of the year if you can.

3) After maxing out traditional retirement, contribute part of each paycheck ($500, $1000, $2000, or whatever your can afford) into tech stocks or tech-heavy ETF's.See title.

Always Neg Back Crew.

-

-

05-25-2021, 08:39 AM #5

If your going tech like Leftical says Vanguard's Information Technology fund, VGT is tech based. Plates ^ saying that Vanguards Total Market fund VTI is better then the S&P 500 is also a good piece of advice.

Cathie Wood (Of Ark Invest) is speculating that a lot of major companies in the S&P 500 aren't spending enough money on research and innovation. She thinks as much as half of those companies will be dead or dying in the future. Which is insane to think about. The world is changing rapidly and I do believe Cathie Wood has the best idea of where the market is heading in the future.

Assuming you want to be well balanced something like 33% VTI, 33% VGT and 33% ARKK would be a solid portfolio in my opinion. Mine will most likely end up being VTI, VGT, ARKG and Tesla.

-

05-25-2021, 08:49 AM #6

Going heavily into tech is just a gamble. I also wouldn't DCA, lump sum is statistically better (time in the market > timing the market) but if it'll have adverse psychological impacts on you, then just DCA.

VTI/VXUS 80/20 is fine for the stock portion.

BND allocation according to risk tolerance.

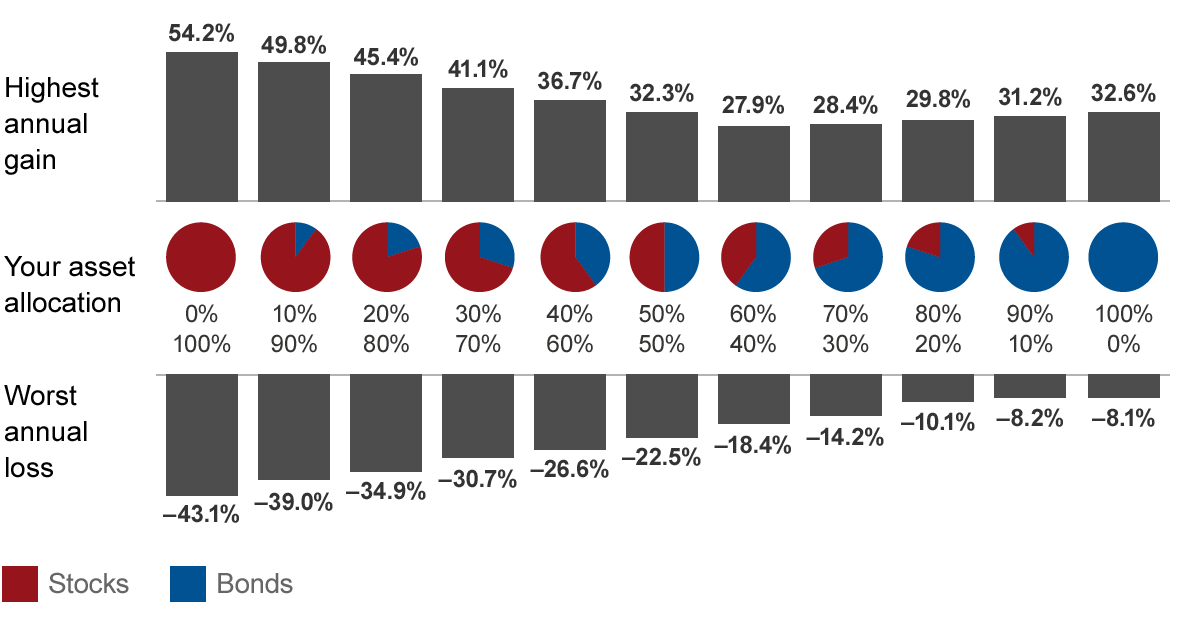

I wouldn't let bond rates influence the decision, this is merely a risk tolerance calculation. Some bond allocation has historically shown better risk adjusted returns, although stocks obviously have greater overall return with higher volatility.

𝕮𝖍𝖆𝖘𝖊 𝖆 𝖈𝖍𝖊𝖈𝕶, 𝖓𝖊𝖛𝖊𝖗 𝖈𝖍𝖆𝖘𝖊 𝖆 𝖇𝖎𝖙𝖈𝖍

𝕮𝖍𝖆𝖘𝖊 𝖆 𝖈𝖍𝖊𝖈𝕶, 𝖓𝖊𝖛𝖊𝖗 𝖈𝖍𝖆𝖘𝖊 𝖆 𝖇𝖎𝖙𝖈𝖍

-

05-25-2021, 09:11 AM #7

sell puts on stocks you would like to own, 30-45 DTE at interesting price points. If you get assigned, just leave them (unless you get bored and want to sell covered calls). If you don't, rinse/repeat every 30-45 days.

"It won't get better, just different."

“Yeah, that's what the present is. It's a little unsatisfying because life's a little unsatisfying.”

Bring back ****got, ****got .

-

07-12-2021, 04:55 PM #8

-

-

07-12-2021, 05:57 PM #9

-

07-12-2021, 07:19 PM #10

-

07-12-2021, 07:21 PM #11

Bookmarks