not at all, i love renting. Home prices will come back down in the next few years once interest rates go up

|

|

-

04-22-2021, 06:48 PM #31

-

04-22-2021, 06:53 PM #32

-

-

04-22-2021, 08:22 PM #33

BuT THiS TimE Is DIffeREnT.

Not srs.

We're in an asset bubble boyos, plain and simple.

in b4:

muh supply

muh demand

muh qualified buyers

muh all-cash buyers.

You're forgetting the most important one:

muh Fed market manipulation

Remember one of the biggest warning signs of a bubble: People saying "this time is different".

It's not different. The Fed is fueling a debt-filled super party but everyone, even them, knows we're just circling the toilet.Misc Entrepreneur Crew

-

04-22-2021, 08:29 PM #34

-

04-22-2021, 08:36 PM #35

-

04-22-2021, 09:54 PM #36

-

-

04-22-2021, 10:09 PM #37Registered User

- Join Date: May 2009

- Location: Chicago, Illinois, United States

- Age: 39

- Posts: 7,908

- Rep Power: 43502

Most miscers shouldn't even be commenting on this. There's such a lack of housing supply at the moment that nothing short of a total economic collapse is going to seriously hurt the market.

Everyone's screaming bubble but refuse to take market inventory into account. This has zero resemblance to 2008. Banks are also not giving out sub prime mortgages to people that can't afford the property.Mod neg Cry-Baby Crew

NEG ONLYFANS THREADS CREW

EPSTEIN DIDN'T KILL HIMSELF CREW

RAW DOG CREW - PRESIDENT OF THE COMPANY

-

04-23-2021, 02:58 AM #38Investing the difference

- Join Date: Feb 2013

- Location: East Coast, Australia

- Posts: 20,579

- Rep Power: 396258

By reading this post you acknowledge r32gojirra is an online persona and all posts by r32gojirra are satirical in nature. Comments by r32gojirra shall not reflect on the integrity and morals of the author portraying the online character nor any professional or contractual affiliates of the author.

By reading this post you acknowledge r32gojirra is an online persona and all posts by r32gojirra are satirical in nature. Comments by r32gojirra shall not reflect on the integrity and morals of the author portraying the online character nor any professional or contractual affiliates of the author.

AP4C

HTC

Repped by kimm into 200kcrew crew

-

04-23-2021, 03:27 AM #39

The only advantage I can see of renting is that I like to move around every 3-4 years even if it’s within a town. It’s nice to live in a new place for the first year and have lots of projects making it new and it just feels different. It also helps create memories etc. I was always happy for years and remember things better for the first few years after moving. Once you’ve been landed for a while, while it is nice things start to blend together. While it isn’t impossible it’s way more foolish to move a lot if you’re buying because you are wasting tens of thousands on closing costs and fees. When I move when renting I just get a 20’ truck another guy or two for big pieces and do everything myself. I’m about to buy but the main thing holding me back now is quite unexpected because I’m wondering if keeping renting so I can move around more freely is actually better

-

04-23-2021, 05:50 AM #40

Please don't fall into the "this time is different" trap.

The 2008 bubble is not like the 2021 bubble. That doesn't mean the bottom will not fall out.

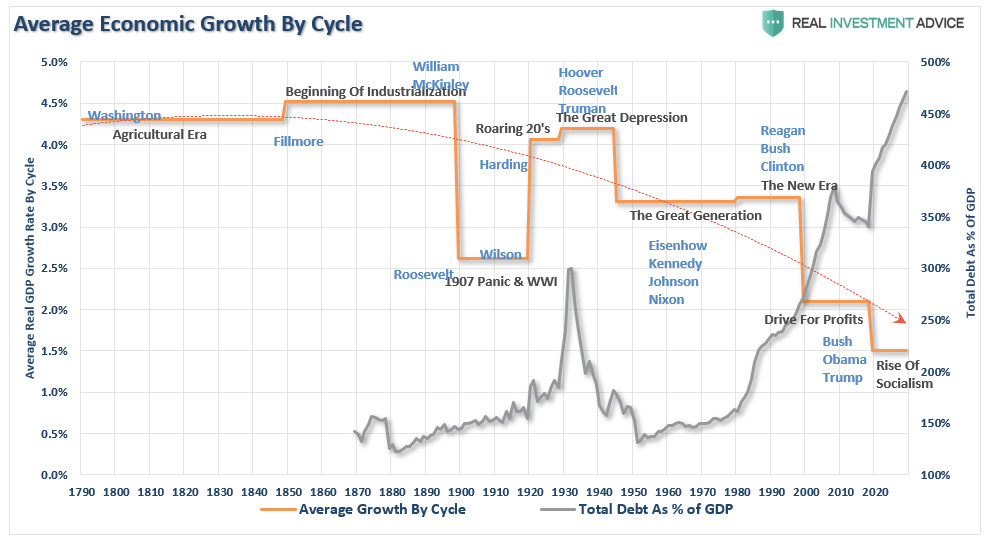

Inventory is one of the causes of this price hike, but there are bigger factors in play here, the main ones being: Long-term low/zero interest rates, a money printer with a broken handle, and a pandemic that has seriously fooked with the markets.

The main issue here is not the housing market, but the market as a whole. We are in an everything bubble and we have been for years. Inflation will eventually force the Fed's hand and they'll have to increase rates. When they do, goodnight sweet prince.

Combine an economy that is surviving on debt and the generosity of the Fed with rising interest rates and you have a powder keg waiting to go off.

You're going to see a lot of businesses go under. If 20% of the population loses their job, we're going to see a massive flood of homes hit the market.

The alternative is that the Fed continues to print money. This will ultimately lead to stagflation, as we're already starting to see.

You have to remember brah, we never really got out of the 2008 recession. The Fed has tried to print their way out, but they have just been kicking the can. Just because the markets are up, does not mean the economy is healthy. Just because inventory is down, does not mean we're not in a bubble.Misc Entrepreneur Crew

-

-

04-23-2021, 06:07 AM #41

-

04-23-2021, 06:18 AM #42

The market in Canada has just gone crazy in the last 18 months, my house that I bought less than a year ago has gone up 100k$, if I were to sell it today.

Key to a great body : a great diet with enough proteins, lot of sleep, not buying tons of supplements, proper form and dedication

3 Must have supplements : High-quality whey isolate, Multivitamins and Creatine

-

04-23-2021, 06:27 AM #43

Either stagflation or continued inflation, depending on productivity.

I'm leaning towards stagflation. Look around. When you combine low supply and slow economic growth with high inflation, you have stagflation. With the exception of food, clothing, and cheap products, most things are either out of stock or have had a significant price increase. Hell, even kids playgrounds have increased 40-50% in the past 2 years.

The Fed's job is to slow the curve either way, but they've basically used all of their tricks, and for far too long. Even they are starting to realize they can't keep this up forever, and are kind of subtly warning us that the party will end soon.Misc Entrepreneur Crew

-

04-23-2021, 06:37 AM #44

-

-

04-23-2021, 07:42 AM #45

-

04-23-2021, 10:32 AM #46

-

04-23-2021, 10:42 AM #47

His video was from 12/20. This is from 03/21. Same general theme.

https://nationalinterest.org/feature...isaster-180266In the wake of the September 2008 Lehman bankruptcy, it was clear that troubles in the U.S. economy had serious ramifications for the rest of the global economy. Indeed, the bursting of a U.S. housing and credit bubble had ripple effects throughout world financial markets, which precipitated what economists now call the Great Economic Recession.

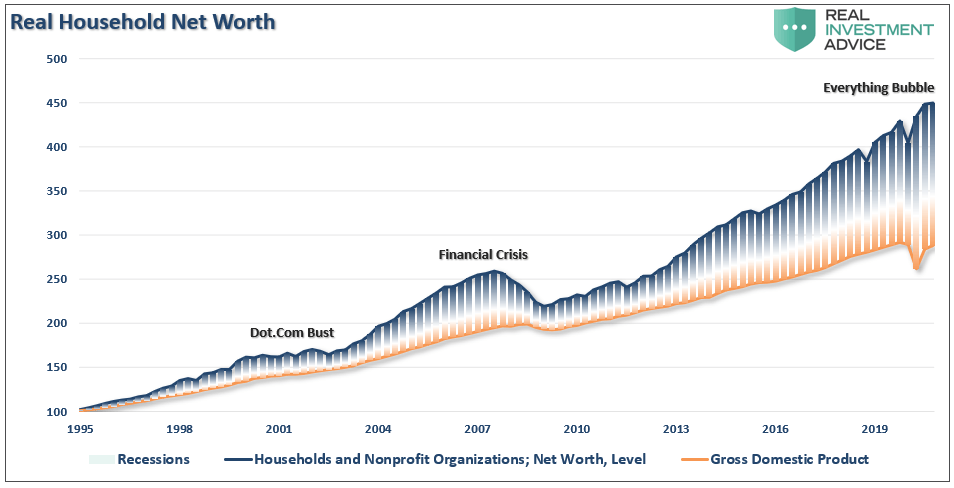

Fast forward to 2021. Now, America’s massive monetary and fiscal policy experiment is being conducted against the backdrop of a so-called everything asset and credit price bubble, which is very much larger and more pervasive than the earlier U.S. housing and credit market bubble.

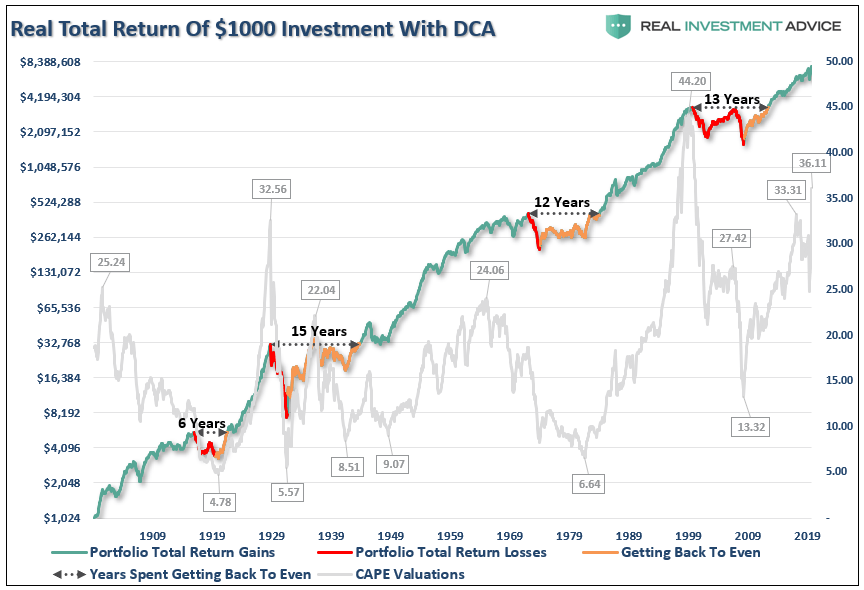

It is not simply that U.S. equity valuations are at the lofty levels last experienced on the eve of the 1929 stock market crash. Nor is it that the dubious Bitcoin market now has a valuation in excess of $1 trillion. Rather it is also that very risky borrowers, especially in the highly leveraged loan market and in the emerging-market economies, can raise money at interest rates not much higher than those at which the U.S. government can borrow.

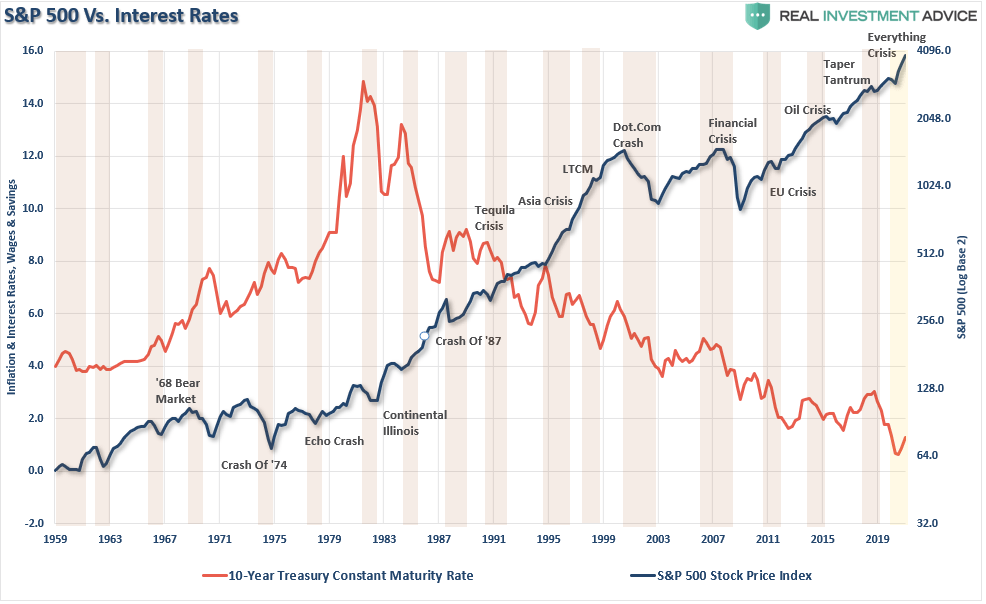

Today’s everything bubble has been inflated by the extraordinarily low interest rates produced by the massive amount of central bank money printing in response to the coronavirus pandemic. This raises the question as to what happens when the pleasant easy money music stops and interest rates start to rise. Past experience would suggest that when that happens, bubbles will start bursting and the emerging market economies will run into serious trouble as money is repatriated to the United States.

Or this from Seeking Alpha:

https://seekingalpha.com/article/440...rything-bubbleRecently, I discussed the “Two Pins That Pop The Bubble,” specifically noting the risk of rising interest rates and inflation. However, the real threat is not just the stock market bubble’s deflation but rather blowing up the “everything bubble.”

During previous periods in financial history, the focus was primarily on the deflation of a singular market bubble.

The flood of liquidity and ultra-accommodative monetary policies has simultaneously inflated multiple bubbles. Stocks, bonds, real estate, and speculative investments have all experienced historic inflations.

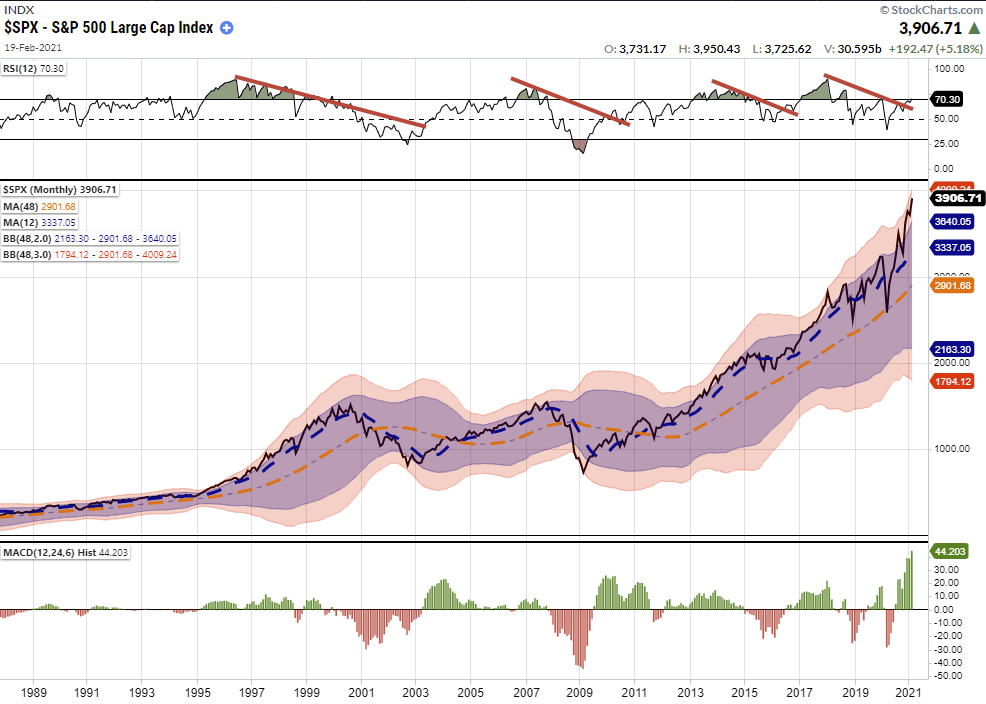

There is little argument that financial markets are currently in a “bubble.” The monthly chart of the S&P 500 shows the deviation from long-term monthly means at levels not seen since 1990.

During a “market mania,” investors must continue to rationalize overpaying for assets to keep prices moving higher. Over the last decade, the most common justification remains that low discount rates justify high valuations.

The problem comes when interest rates rise. Throughout history, an unexpected surge in interest rates has repeatedly led to poor investor outcomes.

Despite media rhetoric that “rising rates” aren’t a problem for the stock market, history suggests they are. Given the massive surge in corporate leverage promulgated by weak economic growth, higher rates will quickly impact corporate profitability and financing activities.

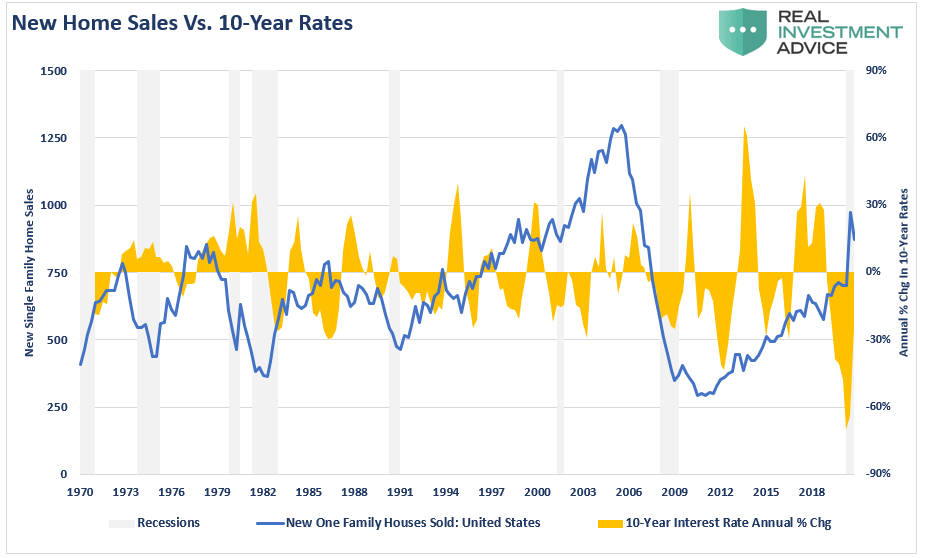

Currently, there is also a “bubble” once again in housing as a continual suppression of borrowing costs, loose lending policies, and a flood of stimulus has led to a historical surge in home prices. As we noted previously in “There Is No Supply Shortage,” home price appreciation has once again eclipsed long-term price trends.

The current overvaluation in homes, of course, is driven by record-low mortgage rates.

However, as noted above, that economic support will quickly reverse as interest rates rise. Given there is a surging demand for homes, just as with the stock market, when rates rise, there will be a rush to sell to a diminishing pool of buyers.

Also, as with the stock market, owned by the top 20% of income earners, most houses bought were by that same fraction of the population. [Higher incomes and nearly perfect credit].

Of course, there is nowhere more at risk from higher rates than the bond market itself. Given that “yield” is a function of price, there is a perfectly negative correlation between prices and interest rates.

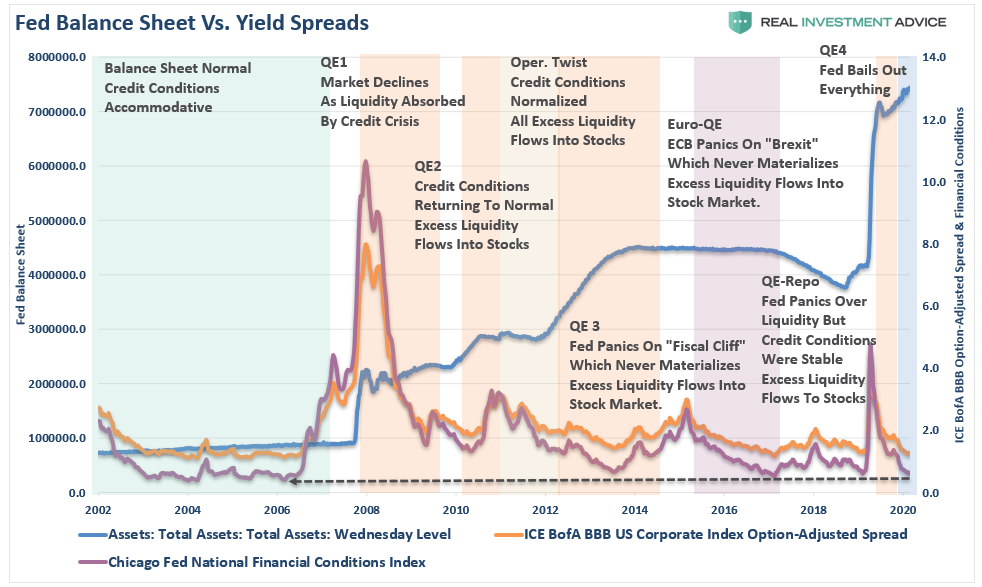

The Federal Reserve problem is they have now pushed “yield spreads” across the entirety of the credit spectrum to record lows. The Fed’s suppression of rates to “bail-out” the bond market in the short-term has created a long-term problem of “mispricing risk.”

That mispricing of risk, or rather the creation of “moral hazard,” in the credit markets created a record number of “zombie” companies in the process.

Eventually, when rates rise enough, these “zombie” companies will be unable to refinance debt for their continued survival. Once bankruptcies begin to spike uncontrollably, investors will demand to get paid for their investment risk. As shown, such has occurred in the past with relatively dismal outcomes.

What should be clear is that if the rise in interest rates approaches 2% or higher, there are many problems embedded in an economy laden with nearly $85 trillion in debt.

The US economy is literally on perpetual life support. Recent events show too clearly that unless fiscal and monetary stimulus continues, the economy will fail and, by extension, the stock market.

However, the Fed currently has no choice.

Such is the consequence, and problem, of getting caught in a “liquidity trap.”

What the average person fails to understand is that the next “financial crisis” will not just be a stock market crash, a housing bust, or a collapse in bond prices.

It could be the simultaneous implosion of all three.Last edited by katya422; 04-23-2021 at 11:00 AM.

INTP Crew

Inattentive ADD Crew

Mom That Miscs Crew

-

04-23-2021, 10:49 AM #48

-

-

04-23-2021, 11:02 AM #49

-

04-23-2021, 11:13 AM #50

-

04-23-2021, 11:27 AM #51

-

04-23-2021, 11:55 AM #52

-

-

04-23-2021, 12:43 PM #53

-

04-23-2021, 12:52 PM #54

-

04-23-2021, 12:59 PM #55

-

04-23-2021, 01:20 PM #56

-

-

04-23-2021, 01:35 PM #57

-

04-23-2021, 01:38 PM #58

I personally stay invested in a variety of assets with cash on hand. Invest in Real-Estate (if the bubble pops, rentcel demand goes up), Stocks (typically beat inflation), Commodities (to spread your assets and have physical currency on hand), take on long term fixed rate loans if you can afford it.

If you lose your a$$ in all of the above, well everyone is just as broke as you.★★★ A State of Trance Crew ★★★

♞♞♞ Misc Horse Head Crew ♞♞♞

-

04-23-2021, 03:25 PM #59

-

04-23-2021, 03:47 PM #60Registered User

- Join Date: Jan 2006

- Location: United Kingdom (Great Britain)

- Age: 49

- Posts: 16,193

- Rep Power: 60251

Bookmarks